nebraska sales tax rate on vehicles

Nebraska has recent rate changes Thu Jul 01 2021. However this does not include any potential local or county taxes.

Electric Car Tax Credits Ne Electric Vehicle Incentives

Vehicles are considered by the IRS as a good that can be purchased sold and traded.

. Nebraska also has special taxes for certain industries that may be on top of or in lieu of the state and local sales. Sales Tax Rate Finder. Nebraska has a state sales tax of 55 percent for retail sales.

FilePay Your Return. Registration Fees and Taxes. Nebraska Department of Revenue.

Average Local State Sales Tax. With local taxes the total sales tax rate is between 5500 and 8000. The state capitol Omaha has a local tax of 25 on prepared food and.

Maximum Possible Sales Tax. Driver and Vehicle Records. How Much Is the Car Sales Tax in Nebraska.

With local taxes the total sales tax rate is between 5500 and 8000. This is less than 1 of the value of the motor vehicle. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax.

Waste Reduction and Recycling Fee. In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

Counties and cities in Nebraska are allowed to charge an additional local sales tax on top of the state sales tax. The state sales tax on a car purchase in Nebraska is 55. Subsequent brackets increase the tax 10 to 40 for each 2000 of value when new or two percent.

The Nebraska state sales and use tax rate is 55 055. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022. Therefore you will be required to pay an additional 55 on top of the purchase price of the vehicle.

The state sales tax rate in Nebraska is 5500. This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. Contact your County Treasurers office for more information.

Interactive Tax Map Unlimited Use. Ad Lookup Sales Tax Rates For Free. How Does Sales Tax Apply to Vehicle Sales.

Some localities collect additional local fees and taxes. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Sales and Use Taxes.

Additionally city and county governments can impose local sales and use tax rates of up to 2 percent.

Sales Tax Laws By State Ultimate Guide For Business Owners

Nebraska State Tax Things To Know Credit Karma

How To File And Pay Sales Tax In Nebraska Taxvalet

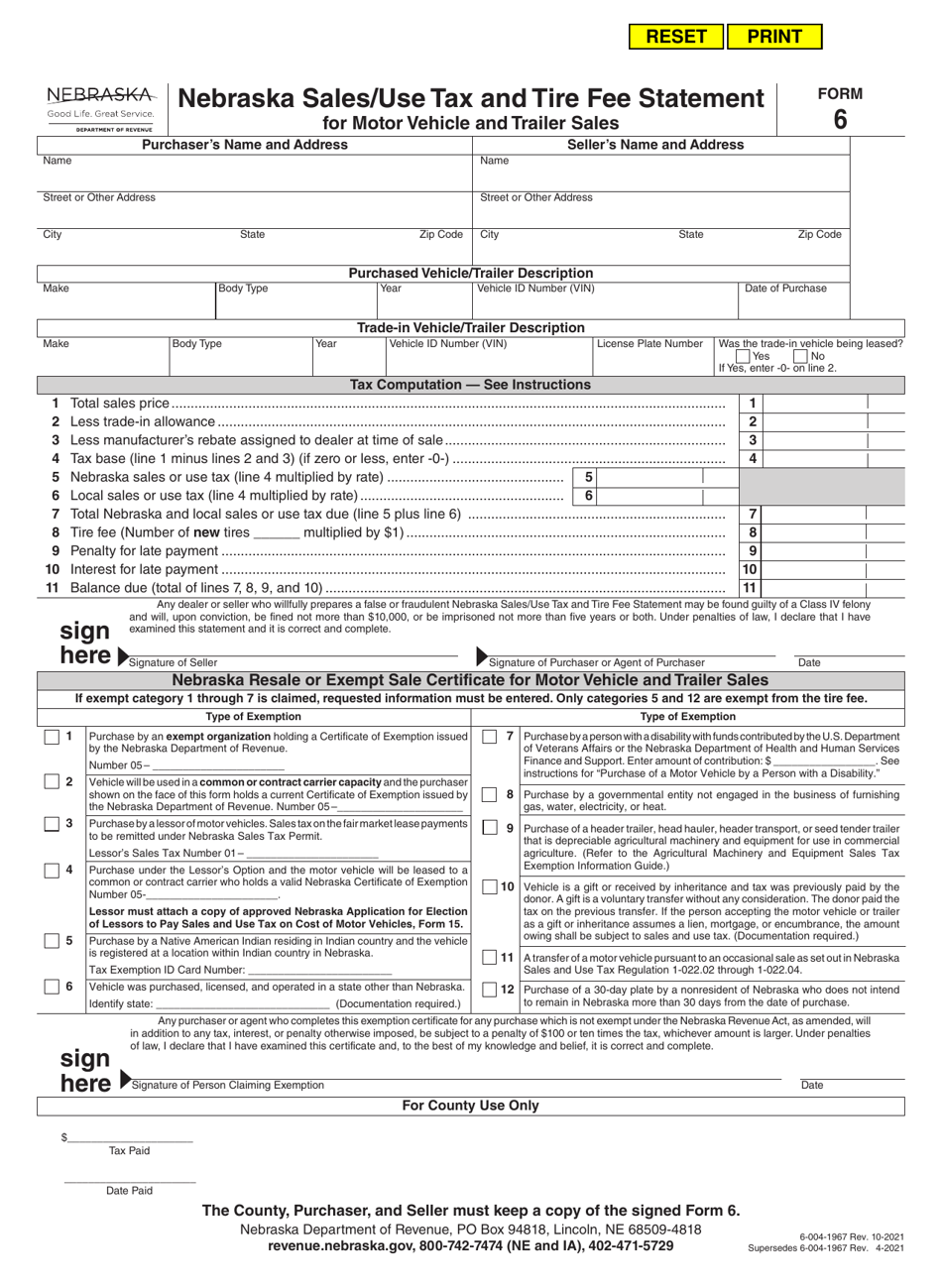

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Taxes And Spending In Nebraska

Used Cars For Sale In Nebraska Edmunds

Welcome Nebraska Department Of Motor Vehicles

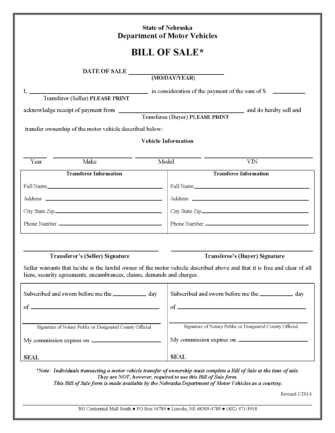

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

Car Tax By State Usa Manual Car Sales Tax Calculator

Welcome Nebraska Department Of Motor Vehicles

Taxes And Spending In Nebraska

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Vehicle Bill Of Sale Without Notary Form Fill Out And Sign Printable Pdf Template Signnow

Sales Tax On Cars And Vehicles In Kansas

Nj Car Sales Tax Everything You Need To Know

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow